Clethodim is a post-emergence cyclohexenone herbicide that is highly safe for broadleaf crops. It effectively controls grass weeds and is less affected by environmental conditions. With broad application potential, it is the herbicide of choice for crops such as soybeans and cotton.

According to LookWhole Insight, the global Clethodim market is projected to reach USD 589.62 Million in 2024. It is expected to grow to USD 1200.05 Million by 2033, registering a compound annual growth rate (CAGR) of 6.57% during the forecast period (2025–2033).

Clethodim Introduction

Clethodim is a post-emergence cyclohexenone herbicide that is highly safe for broadleaf crops. It effectively controls grass weeds and is less affected by environmental conditions. With broad application potential, it is the herbicide of choice for crops such as soybeans and cotton.

- l Mode of Action: Clethodim inhibits acetyl-CoA carboxylase (ACCase) in weeds, blocking fatty acid synthesis and ultimately damaging cell membranes.

- l Target Weeds: Mainly grass weeds such as barnyard grass, green foxtail, goosegrass, and reeds.

- l Applicable Crops: Broadleaf crop fields, including soybeans, cotton, rapeseed, peanuts, sugar beet, and flax.

Major Supply Shock Event

On April 22, 2025, a major safety incident occurred during the resumption of production at Yifan Biotech’s Ningxia plant, the global leader in clethodim production. The accident caused the complete suspension of its 8,000-ton annual production capacity. The shutdown is expected to last at least three months. Combined with increasingly strict environmental regulations in Ningxia and delays in technological upgrades by smaller producers, the industry's effective capacity has suddenly dropped below 45,000 tons per year. Yifan’s capacity accounts for more than 10% of global supply. This event marks the second major supply shock after Yifan’s environmental shutdown in 2023, and the full-year effective capacity gap may expand to 30%.

In fact, clethodim supply is relatively concentrated. Following the Yifan accident, the industry lost 20–25% of supply. Additionally, as the company’s production license is set to expire and is unlikely to be renewed this year, the plant is not expected to resume production. On the demand side, soybean acreage in South America is projected to grow by 10%, and in China by 15%, resulting in a clear supply-demand mismatch. As there is currently no effective substitute for clethodim’s weed control efficacy in soybeans—and given that clethodim costs account for less than 1% of total planting costs—buyers have a strong tolerance for price increases. Experts predict prices could exceed RMB 180,000 in August and RMB 220,000 in October, setting a new historical high. Xianda Co., with a 10,000-ton capacity (the world’s largest), is expected to benefit the most from the price surge due to its 60% export share and leading market position.

Clethodim Production Landscape

Clethodim Production Landscape

|

Company |

Production Capacity (tons/year) |

Status |

Notes |

|

Xianda Co. |

10,000 |

Operating |

World's largest producer; export share over 60% |

|

Yifan Biotech |

8,000 |

Halted (accident) |

Shutdown due to April 2025 accident; unlikely to resume in 2025 |

|

Hebei Lansheng Biotech |

8,000 |

Operating |

One of the top three domestic producers |

|

Meibang Co. |

2,000 |

Operating |

Export share over 50% |

|

Yingtai Biotech |

2,000 |

Operating |

Export share over 40% |

|

Zhongnong United |

1,500 |

Operating |

Export share around 40% |

|

Changqing Co. |

~1,000+ |

Operating |

Small-scale producer |

|

Yangnong Chemical |

5,000 (planned) |

In production, gradual ramp-up |

Expansion in progress |

|

Runfeng Co. (Ningxia) |

8,000 (planned) |

Under construction |

Expected commissioning in H2 2026 |

Yifan Biotech had previously been a key supplier but is now projected to complete equipment upgrades, compliance procedures, and automation improvements by Q3 2025 (around October). However, due to the severity of the incident and the expiration of its production license in October, it is highly unlikely to resume production this year. The two main constraints are: (1) tightened safety and environmental regulations, which hinder restarts, and (2) the need for license renewal in October, which may be difficult to obtain due to safety record concerns.

Supply and Demand Outlook and Price Analysis

Upstream Raw Materials

Key raw materials for clethodim include propionyl chloride, ethanethiol, fluorophenol, and chlorophenol. Ethanethiol and fluorophenol are classified as hazardous chemicals with complex, flammable, and explosive synthesis processes, making licensing difficult. These materials are mostly imported due to limited domestic production. While companies generally do not outsource raw materials, large quantities of propionyl chloride must be imported, with other components available domestically.

Downstream Demand

China’s annual clethodim output is around 45,000 tons, with over 60% exported—mainly to South America (Brazil, Argentina) and the United States. The peak global demand period is from May to October. Domestically, the Northeast China market is also growing, as GMO soybean acreage is up 15% year-on-year, pushing clethodim demand up 15–20%. Globally, planted acreage is expected to grow by about 10%, significantly increasing herbicide demand.

Price Trends

Short-term: Clethodim prices rose on May 26 and June 7. As of June 9, prices reached RMB 140,000–150,000. Given the global demand surge from June to October, prices are expected to hit RMB 160,000–180,000, with August potentially exceeding RMB 180,000.

Long-term: According to LookWhole Insight, prices could surpass RMB 220,000 in October, breaking historical records. Even with some capacity coming online by Q4 or early next year, the price is expected to remain elevated due to Yifan’s continued shutdown.

Price Trends

|

Time Point |

Price (RMB/ton) |

Price (USD/ton) |

Remarks |

|

May 26, 2025 |

140,000 |

~$19,310 |

Short-term price increase begins |

|

June 7, 2025 |

150,000 |

~$20,690 |

Continued market tightening |

|

June 9, 2025 onward |

140,000–150,000 |

~$19,310–$20,690 |

Official new market price range |

|

Forecast (June–July) |

160,000–180,000 |

~$22,070–$24,830 |

Peak season demand drives price further |

|

Forecast (August) |

>180,000 |

>$24,830 |

Expected to exceed this due to global supply crunch |

|

Forecast (October) |

>220,000 |

>$30,340 |

Potential all-time high, driven by sustained shortage |

Customer Price Acceptance

For soybean fields, clethodim is applied at a rate of 5–40 ml of 12% EC or 28–40 ml of 24% EC per acre. The cost per square meter is approximately USD $0.62, which is less than 1% of total planting costs. This low cost share gives customers strong tolerance for price increases.

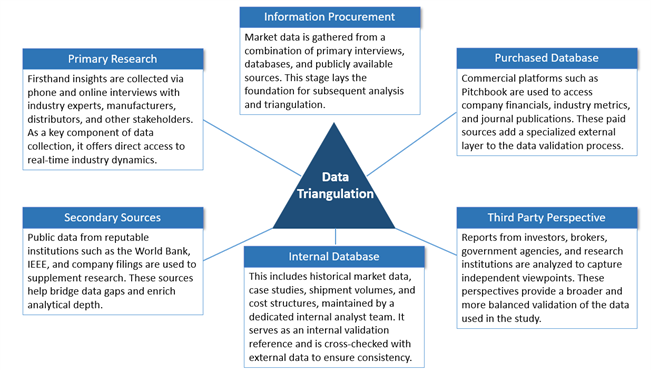

The following is a brief introduction of the latest report released by LookWhole Insight. This report systematically compiles global data on the clethodim market, including production capacity, sales revenue, pricing, and future development trends. It provides in-depth analysis of various market segments from multiple perspectives—such as key manufacturers, product types, application areas, and regional markets. The report comprehensively examines the product characteristics, market positioning, business performance, and market shares of major players in both the global and Chinese markets. It aims to offer a thorough and objective market research resource for industry stakeholders, investors, and policy makers. Additionally, it serves as a reliable decision-making tool for market analysts, investment professionals, and government agencies.

Market Report Coverage & Segmentation

|

ATTRIBUTE |

Details |

|

|

Time Coverage |

Historical Year: 2020– 2024 Base Year: 2024 Estimated Year: 2025 Forecast Year: 2025 - 2033 |

|

|

Market Segmentation |

||

|

By Type |

Emulsifiable Concentrate (EC) Soluble Concentrate (SL) Others |

|

|

By Application |

Soybean Rapeseed Cotton Peanut Other |

|

|

By Company |

Lansheng Biotechnology Group Co., Ltd. Shandong Cynda Chemical Co., Ltd. Shaanxi Meibang Pharmaceutical Group Co., Ltd. Hubei Xingfa Chemicals Group Co., Ltd. UPL Ltd. Syngenta Group Bayer AG Jiangsu Evergreen Agrochemical Co., Ltd. Shandong Weifang Rainbow Chemical Co., Ltd. Beijing Fineicare Biotechnology Co., Ltd. Taihoo Chemical Group Co., Ltd. Yangnong Chemical Group Co., Ltd. Sichuan Fuhua Tongda Chemical Co., Ltd. Jiangsu Jiangshan Agrochemical Co., Ltd. Jiangsu Hoffman Agriculture and Chemical Co., Ltd. |

|

|

By Region |

North America |

|

Report Framework and Chapter Summary

Chapter 1: Report Scope and Market Definition

This chapter outlines the statistical boundaries and scope of the report. It defines the segmentation standards used throughout the study, including criteria for dividing the market by region, product type, application, and other relevant dimensions. It establishes the foundational definitions and classifications that guide the rest of the analysis.

Chapter 2: Executive Summary

This chapter presents a concise summary of the market’s current status and future outlook across different segments—by geography, product type, and application. It includes key metrics such as market size, growth trends, and development potential for each segment. The chapter offers a high-level overview of the Clethodim Market, highlighting its evolution over the short, medium, and long term.

Chapter 3: Market Dynamics and Policy Environment

This chapter explores the latest developments in the market, identifying key growth drivers, restraints, challenges, and risks faced by industry participants. It also includes an analysis of the policy and regulatory landscape affecting the market, providing insight into how external factors may shape future performance.

Chapter 4: Competitive Landscape

This chapter provides a detailed assessment of the market's competitive environment. It covers market share, production capacity, output, pricing trends, and strategic developments such as mergers, acquisitions, and expansion plans of leading players. This analysis offers a comprehensive view of the positioning and performance of top competitors.

Chapters 5–10: Regional Market Analysis

These chapters offer in-depth, quantitative evaluations of market size and growth potential across major regions and countries. Each chapter assesses regional consumption patterns, market dynamics, development prospects, and available capacity. The analysis helps readers understand geographical differences and opportunities in global markets.

Chapter 11: Market Segmentation by Product Type

This chapter examines the market based on product type, analyzing the size, growth trends, and potential of each segment. It helps stakeholders identify underexplored or high-potential product categories—often referred to as “blue ocean” opportunities.

Chapter 12: Market Segmentation by Application

This chapter analyzes the market based on application fields, providing insights into the scale and future development of each application segment. It supports readers in identifying high-growth areas across downstream markets.

Chapter 13: Company Profiles

This chapter presents comprehensive profiles of leading companies operating in the market. For each company, it details sales revenue, volume, pricing, gross profit margin, market share, product offerings, and recent strategic developments. This section offers valuable insight into corporate performance and strategy.

Chapter 14: Industry Chain and Value Chain Analysis

This chapter explores the full industry chain, from upstream raw material suppliers to downstream application sectors. It includes a value chain analysis that highlights the interconnections and dependencies across various parts of the ecosystem.

Chapter 15: Key Findings and Conclusions

The final chapter summarizes the main takeaways from the report, presenting the core conclusions, strategic recommendations, and implications for stakeholders. It encapsulates the insights drawn from all previous chapters.